THIS SECTION IS FOR NEWS AND INTERESTING STORIES RELATED TO FOOD, NUTRITION AND FOOD PROCESSING. THEY ARE NOT NECESSARILY RELATED TO KOSHER BUT MAY BE OF INTEREST TO THE KOSHER CONSUMER, MANUFACTURER OR MASHGIACH.

May 9, 2023 - from Globes:

"Electra Consumer Products plans opening 80-100 Carrefour branches around Israel by the end of 2023.

"Fifty branches of Yeinot Bitan, Mega, and Super around Israel have been closed yesterday and today and will reopen tomorrow at midday as Carrefour stores. For more than a year Electra Consumer Products (TASE: ECP), which has the Carrefour franchise in Israel, has been working on the festive opening of the new chain asa well mas all the logistics and marketing and from tomorrow there will be a major ad campaign. Carrefour's online sales site will also start operating tomorrow. The company has invested NIS 250 million in the launch.

"Israel will be the 50th country in which Carrefour operates which is why the company was pushing for 50 branches to open on the first day of operations here. Carrefour already operates 14,000 branches in 49 countries across Europe, the Middle East, East Asia, Africa and South America with annual sales of €81 billion. The company has hundreds of factories producing 14,000 different food products under 20 brands.

"Overall Electra Consumer Products plans opening 80-100 branches around Israel by the end of 2023. Each branch will sell over 1,000 different products in 80 categories including 400 food products including organic food products and 600 non-food products including cleaning products and toiletries.

"There will be three formats for branches: Carrefour City (neighborhood stores); Carrefour Market (medium-sized stores); and Carrefour Hyper (discount stores).

"In the first stage there will be three Carrefour Hypers in Ra'anana, Netanya and Beit Shemesh - each about 2,500-4,000 square meters in size compared with 1,200 square meters for the Carrefour Market stores."

May 4, 2023 - from the Baltimore Jewish Life:

"BJL readers have expressed concern over the current seeming shortage of Kosher certified salads typically otherwise available in abundance at local stores and restaurants. BJL reached out to STAR-K for comment on this matter. We learned that due to the changing seasons in the growing regions, there is currently short supply and high infestation levels in many lettuces and greens. As such, consumers are advised that many regular certified options are not presently available or otherwise in short supply. Please check labels carefully for a proper hashgocho. If you are checking lettuce or greens yourself, please be extra careful to be sure you are checking properly. While this change happens annually and always presents similar challenges, it seems the transition is taking slightly longer this year due to the weather conditions over the last few weeks. Hopefully the situation will improve over the next few weeks as the new growing season in California begins."

May 3, 2023 - from the Jewish Press:

"Israel’s Minister of Energy and Infrastructure Israel Katz submitted Wednesday to the Knesset’s Economy Committee a request to adopt the European standard as the exclusive regulation for the import of electrical appliances to Israel and to cancel the unique Israeli regulation which has much stricter standards that limit the models which can be imported into the country.

"This move is intended to increase competition and bring down prices in the electrical appliance market in Israel, which is estimated at over 10 billion Shekels ($2.72 billion) per year. The reform will lower the cost of importing electrical appliances, increase competition in this economy and facilitate the parallel import of appliances.

"In addition, electrical appliances with a higher level of energy efficiency will arrive in Israel, something that will lead to a reduction in household electricity consumption, a reduction in the cost of living and a reduction in pollution and emissions.

"The reform also allows any importer of an electrical appliance to Israel (which is included in the reform) to do so without the mandatory physical inspection in a certified laboratory to check for conformity to the Israeli standard before importation.

"As an alternative to the physical inspection, the importer must declare that the imported device meets the European legal requirements and provide the Ministry of Energy and Infrastructure with documents proving this. It must also provide an energy rating label, where required."

April 27, 2023 from the Times of Israel:

"Food tech startup says health ministry’s ‘historic’ approval found its animal-free milk protein to be ‘safe, of high-quality, and identical to its cow-derived counterpart’

"Israel has granted local food tech startup Remilk, a developer of cultured milk and dairy, the first regulatory approval of its kind to market and sell cow-free milk products to consumers in the country.

"The Israeli-based startup said that the “historic” regulatory approval by the country’s health ministry clears the path for the sale of dairy products made with Remilk’s non-animal protein that are free of lactose, cholesterol, antibiotics and growth hormones.

"Founded in 2019, Remilk produces milk proteins via a yeast-based fermentation process that renders them “chemically identical” to those present in cow-produced milk and dairy products. The startup claims that the result is 100 percent similar to “real” milk. Remilk recreates the milk proteins by taking the genes that encode them and inserting them into a single-cell microbe, which they manipulated genetically to express the protein. The product is then dried into a powder.

"Earlier this year, Remilk won regulatory approval to sell its cow-free milk in Singapore and a letter from the US Food and Drug Administration that its animal-free whey protein can be safely used in food products. That’s after the company started sales of its protein in the US last year.

"Remilk, which has raised more than $130 million in capital from investors to date, in July inked a large-scale commercial agreement with the Central Bottling Company (CBC Group), the exclusive Israeli franchisee of Coca-Cola, to roll out a line of dairy drinks, cheeses, and yogurts made with its protein, for the Israeli market within 12 months pending the regulatory approval.

"There are a number of companies operating in the dairy alternative space for milk proteins using precision fermentation technology, such as Israeli startup Imagindairy which says its technology recreates nature-identical, animal-free versions of whey and casein proteins that can be used to produce dairy duplicates. Another one is Pigmentum, which has developed a gene-modified plant-based technology to create milk proteins from lettuce that can be used to make cheese."

May 1, 2023 from the FDA:

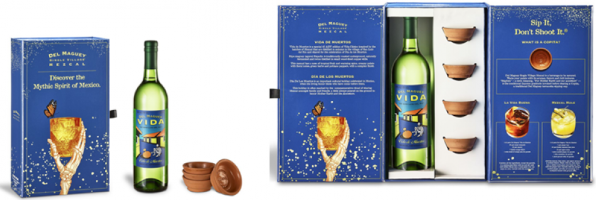

Del Maguey Co., New York, NY is conducting a voluntary recall of certain ceramicware cups called copitas – small artisan cups traditionally used for drinking mezcal – because they may exceed FDA guidance levels for leachable lead.

The copitas were distributed free-of-charge to consumers at retail locations, events and tastings across the United States. Copitas were also included in value-added packs (VAPs) sold by retail stores since October 2022; the VAPs included a 750ml bottle of Del Maguey Vida de Muertos mezcal and 4 copitas. This recall covers all copitas distributed by Del Maguey to date.

The cup is made of red clay, with applied enamel on the surface that holds liquid inside. It holds a maximum of 1 oz, and measures 2.5 inches wide and 1 inch in height. The copitas can be identified by the embossed brand name “Del Maguey Single Village Mezcal” which encircles the word “Mexico” located on the inside of the cup. Images of the copitas and the VAPs sold at retail are pictured below.

No Del Maguey spirit products are part of this recall. In particular, the mezcal included in the VAPs has not been exposed to the copitas, is not covered by this recall, and may be consumed. This recall covers only the copitas.

Consumers should not use and should discard the copitas covered by this recall. Del Maguey is working with a new supplier to resolve this issue and produce new copitas. Consumers who have questions or would like to receive the new copitas may e-mail consumercare@delmaguey.zendesk.com or visit https://delmagueyconsumercare.zendesk.com/hc/en-us/requests/new.

May 1, 2023 - from Vinnews

"The price of government-regulated dairy products in Israel will rise by 9.28% this week after the Finance Ministry stepped in to spread a planned 16% hike over three years.

"Separately, Financed Minister Bezalel Smotrich intervened to cancel a gasoline price hike that was to have taken effect on Monday.

"The moves come as the rising cost of living tops the Israeli public’s list of concerns, according to surveys.

The last-minute agreement reached by Smotrich will see the cost of basic milk and cheese products go up 9.28% with additional 3.1% increases coming each May through 2026.

"Dairy companies will receive compensation for the postponed price rises."

April 30, 2023 - from YeahThatsKosher

"A new Glatt Kosher authentic Moroccan restaurant has just opened in the heart of midtown, centrally located – not far from Grand Central, Bryant Park, Madison Square Garden / Penn Station, and Times Square. Located in the recently closed location of Colbeh / Paprika‘s Manhattan location,

"Note: there is another'Dar Yemma' restaurant in Queens that is not kosher. It is not related to this location in Manhattan."

April 28, 2023 - from Politico:

"New York will require new buildings to be zero-emissions starting in 2026 and make a state authority a major player in developing renewables as part of this year’s budget, Gov. Kathy Hochul announced late Thursday.

"The state’s budget will ban fossil fuel combustion in most new buildings under seven stories starting in 2026, with larger buildings covered in 2029. That means no propane heating and no gas furnaces or stoves in most new construction.

"New York would be the first state to take this step through legislative action; California and Washington have done so through building codes.

"The measure will help the state achieve its ambitious mandate to slash emissions by 40 percent from 1990 levels by 2030 and 85 percent by 2050 and was recommended in a plan approved in December by state agency heads and outside experts. Exemptions will be included for commercial kitchens, emergency generators and hospitals.

"But some key details have not yet been finalized. Hochul also indicated she expects the deal to include rebates to consumers as part of a cap-and-trade initiative for emissions, but a detailed agreement hasn’t been reached on that issue.

"There is no measure that eventually bans the replacement of gas furnaces in existing homes included in the budget, which Hochul had proposed and is recommended in the state’s climate plan. Lawmakers rejected that early on in negotiations. And none of the budget proposals included any measure targeting gas stoves in existing buildings.

"The state budget will include a provision to allow for rebates to New York residents under a cap-and-trade program that is expected to be rolled out in 2025 and will raise gas prices at the pump and home heating fuel costs. Some additional details about how the funds could be spent may also be included but details are not finalized, according to the governor’s office."

March 16, 2023 - from Politico:

"New York lawmakers are on track to enact a statewide ban on gas heating and appliances in new buildings, a major marker in a partisan fight over fossil fuels and consumer choice.

"The state Assembly and Senate, controlled by Democrats, included different versions of a natural gas ban in their budget proposals that are expected to be reconciled, writes POLITICO’s E&E News reporter David Iaconangelo. Democratic Gov. Kathy Hochul has said she supports a ban if it lands on her desk.

"t would be the first state to enact a full natural gas ban for new building developments — effectively requiring them to use electric heating and stoves.

"New York City, along with Seattle; Berkeley, Calif.; Eugene, Ore.; and Montgomery County, Md., have all passed legislation limiting fossil fuel use in new buildings. Washington state got closest to electrification requirements in 2022, but that included a carve-out for natural gas as a backup.

"On the other hand, 20 states have prohibited municipalities from imposing fossil fuel restrictions on builders.

"On Wednesday, Bay Area regulators in California agreed to phase out sales of gas boilers and water heaters in existing buildings.

"Amy Turner, senior fellow at Columbia University’s Sabin Center for Climate Change Law, says if New York’s the first domino to fall, expect other states to follow suit.

"'If New York state is able to pass a building electrification requirement at this scale,” she said, “it will show other states around the country that this is not so scary, that it’s politically possible, it’s technically possible.'"

March 28, 2023 from the The Guardian:

"A mammoth meatball has been created by a cultivated meat company, resurrecting the flesh of the long-extinct animals.

"The project aims to demonstrate the potential of meat grown from cells, without the slaughter of animals, and to highlight the link between large-scale livestock production and the destruction of wildlife and the climate crisis.

The mammoth meatball was produced by Vow, an Australian company, which is taking a different approach to cultured meat.

"There are scores of companies working on replacements for conventional meat, such as chicken, pork and beef. But Vow is aiming to mix and match cells from unconventional species to create new kinds of meat.

"The company has already investigated the potential of more than 50 species, including alpaca, buffalo, crocodile, kangaroo, peacocks and different types of fish.

"The first cultivated meat to be sold to diners will be Japanese quail, which the company expects will be in restaurants in Singapore this year.

"In 2018, another company used DNA from an extinct animal to create gummy bears made from gelatine from a mastodon, another elephant-like animal.

"Vow worked with Prof Ernst Wolvetang, at the Australian Institute for Bioengineering at the University of Queensland, to create the mammoth muscle protein. His team took the DNA sequence for mammoth myoglobin, a key muscle protein in giving meat its flavour, and filled in the few gaps using elephant DNA.

"This sequence was placed in myoblast stem cells from a sheep, which replicated to grow to the 20bn cells subsequently used by the company to grow the mammoth meat.

"No one has yet tasted the mammoth meatball. 'We haven’t seen this protein for thousands of years,' said Wolvetang. 'So we have no idea how our immune system would react when we eat it. But if we did it again, we could certainly do it in a way that would make it more palatable to regulatory bodies'"”

April 20, 2023 from the FDA:

"Today, the U.S. Food and Drug Administration (FDA) issued, for comment, draft guidance to help ensure appropriate labeling of plant-based products that are marketed and sold as alternatives to milk (plant-based milk alternatives, or PBMA). This draft guidance will provide industry with recommendations that will result in clear labeling to empower consumers with information to help them make more informed purchasing decisions. It also clarifies that the common or usual names of some PBMA have been established by common usage, and these names include “soy milk” and “almond milk.”

"The FDA recommends that PBMA products that are labeled with the term “milk” in their names, such as “soy milk” or “almond milk,” and that have a nutrient composition that is different than milk, include a voluntary nutrient statement that conveys how the product compares with milk based on USDA’s Food and Nutrition Service (FNS) fluid milk substitutes nutrient criteria. These statements will help consumers make informed dietary choices when it comes to understanding certain nutritional differences between plant-based products that are labeled with “milk” in their names and milk. If a PBMA is not labeled with “milk” as part of its name, but instead is labeled with another term like “beverage” or “drink” and does not make a claim comparing the product to milk, then the voluntary nutrient statement recommendations in the draft guidance do not apply.

"In 2018 the FDA issued notice soliciting comments from the public to gain insight into how consumers use PBMA products and how they understand the term “milk” when included in the names of products made, for example, from soy, peas and nuts. The agency received more than 13,000 comments. After reviewing these comments and conducting focus group studies with consumers, the FDA determined that consumers generally understand that PBMA do not contain milk and choose PBMA because they are not milk. However, many consumers may not be aware of the nutritional differences between milk and PBMA products. For example, almond or oat-based PBMA products may contain some calcium and be consumed as a source of calcium, but their overall nutritional content is not similar to milk and fortified soy beverages and thus they are not included as part of the dairy group in the Dietary Guidelines, 2020-2025. Both the public comments and focus groups helped inform the agency on its recommendations in this draft guidance.

"

| The information posted is from secondary sources. We cannot take responsibility for the accuracy of the information. |

| Comments to webmaster@kashrut.com

© Copyright 2025 Scharf Associates |

|

|||||||||||