THIS SECTION IS FOR NEWS AND INTERESTING STORIES RELATED TO FOOD, NUTRITION AND FOOD PROCESSING. THEY ARE NOT NECESSARILY RELATED TO KOSHER BUT MAY BE OF INTEREST TO THE KOSHER CONSUMER, MANUFACTURER OR MASHGIACH.

December 26, 2021 from The IsraelHayom:

"Agriculture Ministry says it will kill 320,000 laying hens, in addition to the 244,000 that have already been culled in northern Israel in past week.

"The Agriculture Ministry announced Saturday that hundreds of thousands of additional chickens in northern Israel would be culled, amid a spread of the fatal H5N1 bird flu virus in chicken coops in Moshav Margaliot on the Lebanese border.

"According to the ministry, 320,000 laying hens near Margaliot are to be culled in the coming days, in addition to the 244,000 that have been killed in the town over the past week.

"The move is expected to cause a shortage of some 14 million eggs, out of the 200 million eggs Israelis consume each month.

"The ministry also stated that it was concerned about the possibility of people being infected with the virus via the coops that are adjacent to homes in the moshav.

"According to the ministry, the farmers there failed to report in real-time the rising numbers of poultry deaths, leading to the virus spreading rapidly.

"Many of the chickens were dead by the time ministry inspectors arrived. In one coop, only 70 chickens were found alive out of 2,000.

"On Thursday, the Israel Nature and Parks Authority said one in five of the wild cranes living in or migrating through Israel have been infected with the bird flu, with authorities expecting to have to remove 25 to 30 tons of carcasses.

"Around 100,000 cranes visit the Hula Valley in northern Israel annually, with some 40,000 staying in Israel until early March, when they join those returning from Africa to fly north to Europe and Asia to nest.

"Agriculture Minister Oded Forer has described crowded chicken coops as “a ticking time bomb” that need to be moved from communities to isolated breeding complexes with strict biological safety levels."

December 21, 2021 from The tcjewfolk.com:

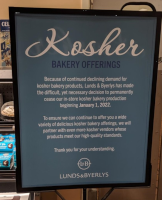

"After abruptly ending the kosher sushi production at the St. Louis Park Lunds & Byerlys last month, the store announced that it would no longer be producing Kosher baked goods in-house, effective Jan. 1, 2022.

"Although the sign next to the baked goods said it was due to declining demand, store general manager Ross Huseby said that – much like the ending of the sushi production – the bakery stopping production of kosher has to do with the retirement of a long-time employee.

"The kosher bakery at the St. Louis Park store also distributes to 24 other Lunds & Byerlys stores. The retirement of baker Draye Olson, Huseby said, is part of a larger challenge in the grocery industry. The Lunds & Byerly’s Mitchell Road store bakery, which distributes products to other stores, has similar problems when it comes to retirements.

"The store stopped producing kosher sushi on Nov. 29, after the retirement of long-time employee and mashgiach Yale Siegal due to an illness. Goldberg said that he passed away last week.

"The kosher supervision had been done originally by Minnesota Kosher, which was then acquired by the Chicago Rabbinical Council."

December 21, 2021 from The Matzav.com:

"At a meeting of the Knesset Labor and Welfare Committee, chareidi and religious MKs complained that 4,000 mashgichim will lose their jobs when a new law breaking up the role of the Rabbinate in kashrus supervision comes into effect.

"Committee Chairman MK Efrat Reitan-Marom agreed there is no plan or solution for their future welfare."

December 16, 2021 from The Food Dive:

"Armed with three years of grocery shopping data, researchers found that total sugar sales are down by almost 20 percent, driven largely by falling soda purchases.

"In a recent analysis, researchers used a large set of grocery shopping data to track food and drink sales before and after the city of Seattle implemented a sugary drinks tax in January of 2018. The data set itself—gathered by marketing insight firm Nielsen—was huge, representing 45 percent of all food store sales in the city for 2017, 2018, and 2019. To create a control group, researchers also obtained the same data for the nearby city of Portland, Oregon, which doesn’t have a sugary drinks tax in place.

"To account for different sugar levels in various beverages, a team led by Lisa Powell, health policy professor at the University of Illinois at Chicago, coded each type of drink by its exact sugar content. In doing so, they found that the total amount of sugar sold through taxed drinks dropped by 23 percent in Seattle compared to sales of the same products in Portland, one year after the implementation of the soda tax. That decline held for the following year as well, suggesting that the dip was not just a fluke.

"But the researchers didn’t stop there. They also wanted to know if shoppers might be getting sugar from other foods instead—a possibility that soda tax opponents have argued would become commonplace. Were Seattle residents simply swapping out Mountain Dew for candy bars? To find out, the researchers also analyzed sales data for untaxed drinks like flavored milk, sweets—which the team defined to include candies, desserts, and baked goods—as well as loose sugar. Over the course of months, Powell’s team painstakingly coded each product sold by its sugar content, and then calculated just how much sales of these products changed after the soda tax went in place.

"They found a slight increase in sugar consumed through untaxed drinks in 2018, which then dissipated in 2019. They also noticed a small, sustained increase in sugar consumed through sweets. In both cases however, those upticks were not large enough to overcome the significant reduction in sugar sold through taxed drinks.

"The findings bolster the city of Seattle’s own early findings about the effectiveness of the soda tax. Last year, researchers at the University of Washington found that low-income families in particular saw a significant decrease in soda consumption following the implementation of the tax. The findings were based on a survey of residents, meaning that it relied on self-reporting, which is less accurate than sales data. However, self-reported numbers play a crucial role in capturing soda sales outside of grocery stores, such as at restaurants and bars, which were not included in Powell’s study.

"The results may have promising public health implications. Almost 60 percent of Americans exceed the Dietary Guidelines’s suggested limit on added sugar consumption. This can contribute to health issues including diabetes and heart disease, making eaters more vulnerable to diseases and more likely to incur higher healthcare costs over the course of their lives.

"Whether these findings might compel other cities to adopt similar policies is still an open question. In response to growing support for soda taxes, food and drink lobby groups have pushed back forcefully to curtail their implementation through a political strategy known as “preemption.” Pioneered by the tobacco industry in the 1970s, this involves lobbying for state-level lawmaking that prevents local jurisdictions from adopting their own public health ordinances.

"And that’s exactly what happened in Washington shortly after Seattle passed its soda tax: In November of that same year, soda companies campaigned successfully for the passage of a ballot initiative banning all future fees on sugary drinks across the state. If Seattle’s neighbors want to pass their own soda taxes, they’ll have to wait for its repeal."

December 21, 2021 from The Matzav.com:

"Data from Israel’s Ministry of Health reveals that chareidim purchase sweet drinks at a rate of 79% compared to 51% in the general population.

"Data from Israel’s Ministry of Health reveals that chareidim purchase sweet drinks at a rate of 79% compared to 51% in the general population.

"The Ministry of Health is going to work to promote a comprehensive program to change dietary habits among the chareidi population after it published disturbing data regarding the consumption of harmful food and drink, and the prevalence of diabetes among the chareidi public.

"According to data, consumption of harmful foods was found to be significantly higher among families in the chareidi community compared to the general Israeli public.

"For example, 78% of chareidi households purchase sweet pastries, compared with 60% of the general public. 89% of chareidi families buy sweet snacks compared to 74% in the general public. But above all, in drinking habits, as mentioned, the chareidi public purchases soft drinks at a rate of 79% compared to 51% in the general public.

"A chareidi family spends about NIS 90 a month on sugary drinks, compared to a family in the general public that spends about NIS 65 a month.

"he situation is even more worrying when examining the data of the National Diabetes Registrar, which show that among the chareidi public, diabetes rates are significantly higher than in the general Jewish public.

"According to the data, the largest gap is in the age group of 25-34, according to which a young chareidi person is 15 times more likely to develop diabetes than a young Jew of a non-chareidi background."

December 15, 2021 from The Jewish Press:

"The Knesset Finance Committee has injected a sour note into the sale of sweetened drinks with the approval Tuesday of a new tax that will apply to nearly all the beverages on the market.

"Sugared drinks, diet drinks and even natural juice will be taxed, beginning in January 2022.

"The decision is likely to impact thousands of small business owners, restaurants and kiosks as well as larger supermarkets.

"The goal, lawmakers say, is to reduce the public’s heavy consumption of sweetened beverages and compel Israelis to switch to water in the battle against obesity, diabetes, heart disease, cardiovascular disease and dental caries.

"Drinks sweetened with more than five grams of sugar per 100 milliliters (ml) will be taxed at one shekel ($0.32) per liter.

"Diet drinks and natural juice will be taxed somewhat less, at 70 agorot ($0.22) per liter.

"Natural grape juice – consumed on the Sabbath each week and at every holiday for the initial blessing on each of two meals in nearly all Israeli Jewish households – will be exempt from the tax.

"Lemon juice, which is used in cooking and at the table at least weekly and in many households – Jewish, Muslim and Christian – will likewise be exempt."

December 13, 2021 from The MedPageToday: osher meals available on return flights.

"Real-world study found only modest benefit for adolescent girls in Mexico.

"Taxes on sugar-sweetened beverages (SSB) hardly made a dent in childhood obesity, but may have helped hold rates steady, a new study suggested.

"In an analysis of Mexican adolescents ages 10 to 18, boys saw no change in BMI, overweight, or obesity prevalence in the years after SSB taxes were put into place, reported Tadeja Gračner, PhD, of the RAND Corporation in Santa Monica, California, and colleagues.

"However, these taxes -- affecting drinks such as sodas, energy drinks, bottled teas, fruit juices, and flavored waters -- had slightly more of an effect on girls, the group wrote in JAMA Pediatrics.

"Specifically, for every 10% increase in the city's average price of a SSB, there was a significant 1.3% absolute decrease in both overweight or obesity prevalence for girls within 2 years of the price change.

"And in relative terms, there was a 2.4% and 3% drop in overweight and obesity prevalence for girls, respectively, for every 10% price increase. However, there was no apparent change within the first year after this tax was implemented.

"Prior to the SSB tax, girls that fell into the 75% or higher percentile for BMI saw an average 0.59 drop in BMI percentile. Gračner's group pointed out this equated to roughly a 0.35-kg (0.8 lb) weight loss for girls. There was no change for girls who didn't have overweight or obesity prior to the tax.

"Gračner's group explained that the estimates they quantified were smaller than other modeling estimates they performed in a U.S.-based cohort.

"Of note, Mexican cities that tacked on a SSB tax higher than 10% saw the best outcomes for weight and metabolic changes for girls.

"The researchers pointed out that this finding wasn't surprising, as prior studies found that SSB taxes that were less than 5% typically had little to no effect on weight-related outcomes. That being said, Gračner's group found that cities with taxes of at least 10% to 16.6% had residents with the highest amount of weight loss.

"albe's group emphasized that the key takeaway from this study is that higher taxes on SSB are associated with improvements in weight outcomes. They went on to highlight another microsimulation study that suggested if Mexico increased this tax rate to about 20%, the country could prevent a projected 476,400 obesity cases over 2 years and a projected 107,300 diabetes cases over 10 years."

December 11, 2021 from The DansDeals:

"Update, 12/11: United tells me that they are currently in the process of looking for local purveyors that can supply kosher meals in each of their domestic Polaris lounges! "Polaris lounges are accessible to customers flying Star Alliance international long-haul business or first class. Domestic Polaris lounges are located in Chicago, Houston, Los Angeles, New York/Newark, San Francisco, and Washington/IAD, though the California Polaris lounges are temporarily closed until sometime in Q1 2022.

"Originally posted on 12/10:

"After months of campaigning to get kosher meals brought back onto United flights, United exclusively tells DansDeals that they will be restoring kosher meal service systemwide!

"Currently, United serves kosher meals on flights in both directions on all Tel Aviv flights and on Newark-London and San Francisco-Sydney flights.

"Here is where you’ll find kosher meals on United:

"You will need to contact United or request a meal under “manage reservations” to request a kosher meal for your existing flights, even if you have kosher meals listed in your preferences. As always, 24 hours advance notice is required."

Ed. note: For Kashrus information about the Fresco kosher meals see https://www.kashrut.com/Alerts/?alert=A7884.

December 14, 2021 from The JTA:

"Europe’s two kosher foie gras factories aren’t in France, by far the leading consumer of the fatty liver product. Nor are they in England, home to Europe’s second-largest Jewish population.

"Instead, they are both in Hungary — where there are few Jews and no more than half a dozen kosher eateries in total.

"Hungary has been doing more than advocating against restrictions on kosher slaughter, or shechitah. It also gives substantial government subsidies and concessions to kosher slaughterhouses that operate within the country.

"The subsidies, combined with the animal-slaughter policies elsewhere in Europe and the supply chain interruptions induced by the COVID-19 pandemic, has turned Hungary into an unlikely major producer of kosher meat for consumption in Europe and Israel. Among its slaughterhouses are the only two devoted to kosher geese in Europe.

"Following the ban in Belgium, a large slaughterhouse for chickens relocated last year from Antwerp to Hungary to stay in business. And when the COVID-19 pandemic caused a shutdown of kosher slaughterhouses in the United Kingdom, the ones in Hungary upped production and one of the abattoirs for geese, Kosher Poultry in the village of Csengele about 75 miles southeast of Budapest, switched to poultry to alleviate the shortages."

December 8, 2021 - from CPSC in conjunction with Heathy Canadians

Free-Standing and Slide-In Electric and Gas Ranges have been recalled because the ranges can tip over when a heavy object is placed on an open oven door and the anti-tip-over bracket is not secured to the wall or floor, posing a tip-over hazard and risk of burn injuries from hot food or liquids in cookware. This recall involves 30-inch, 24-inch, and 20-inch free-standing and slide-in electric and gas ranges, with seven brand names: GE, GE Profile, Café, Haier, Hotpoint, Crosley and Conservator. The brand name, model number and serial number are printed on a label visible on each unit. Ranges with a serial number that starts with either “HS” or “LS” and ends with “P” and have a model number prefix listed in the chart below are included in this recall.

| Brand | Model No. begins: | Brand | Model No. begins: |

| Café | C2S900P | Haier | QAS740 |

| C2S950P | QGAS740 | ||

| CES700P | QSS740 | ||

| CES750P | Hotpoint | RAS200 | |

| CGB500 | RAS240 | ||

| CGS700 | RAS300 | ||

| CGS750P | RBS160 | ||

| CHS900P | RBS360 | ||

| CHS950P | RGAS200 | ||

| Conservator | VBS160 | RGAS300 | |

| VGBS100 | RGBS100 | ||

| Crosley | XBS360 | RGBS200 | |

| XGB635 | RGBS300 | ||

| XGBS400 | RGBS400 | ||

| GE | JAS640 | Profile | P2B935 |

| JB256 | P2S930 | ||

| JB480 | PGB935 | ||

| JBS160 | PGB965 | ||

| JBS360 | PGS930 | ||

| JBS460 | PGS960 | ||

| JGAS640 | |||

| JGB635 | |||

| JGB645 | |||

| JGB660 | |||

| JGB735 | |||

| JGBS10 | |||

| JGBS30 | |||

| JGBS60 | |||

| JGBS61 | |||

| JGBS66 | |||

| JGBS86 | |||

| JGS760 | |||

| JGSS66 | |||

| JGSS86 | |||

| C2S900P | |||

| C2S950P | |||

| CES700P | |||

| CES750P | |||

| CGB500 | |||

| CGS700 | |||

| CGS750P |

Consumers should contact GE Appliances to determine if their unit is part of the recall and to schedule a free in-home service call to inspect the recalled range’s anti-tip bracket and ensure it is securely installed in the floor or wall. Consumers can continue to use the recalled ranges but are cautioned not to place any objects on the open oven door until the range’s anti-tip bracket has been inspected and repaired, if necessary. Consumers should not return the recalled ranges to the place of purchase, as retailers are not prepared to take the units back. The firm is contacting all known purchasers directly.

Sold At: Lowe’s, Home Depot, Best Buy and other home improvement and home appliance stores nationwide and online from May 2021 through July 2021 for between $580 and $4,600, depending on the model.

Consumer Contact: GE Appliances toll-free at 877-247-9770 from 8 a.m. to 5 p.m. ET Monday through Friday, online at www.geappliances.com and click on “Appliance Recalls” at the bottom of the page or https://www.geappliances.com/ge/recall/ for more information.

| The information posted is from secondary sources. We cannot take responsibility for the accuracy of the information. |

| Comments to webmaster@kashrut.com

© Copyright 2025 Scharf Associates |

|

|||||||||||